10. 10. 2024 - Josef Brynda

9. 10. 2024 - Josef Brynda

8. 10. 2024 - Josef Brynda

7. 10. 2024 - Josef Brynda

2. 10. 2024 - Josef Brynda

1. 10. 2024 - Josef Brynda

30. 9. 2024 - Josef Brynda

26. 9. 2024 - Josef Brynda

China’s top leaders ramped up efforts to revive growth with pledges to support fiscal spending and stabilize the beleaguered property sector, giving new momentum to stimulus measures aimed at arresting a slowdown in the world’s second-largest economy.

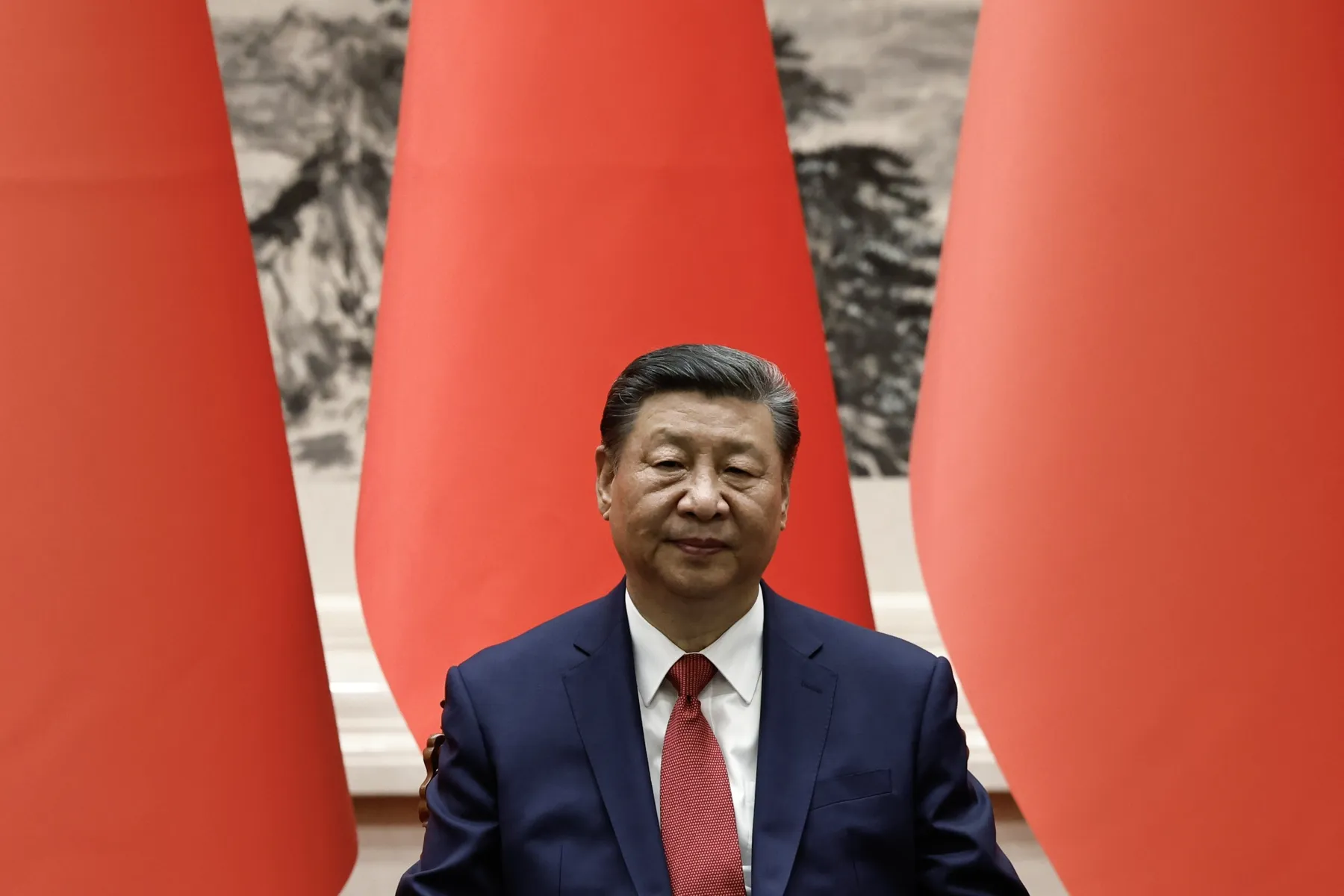

President Xi Jinping’s huddle of the 24-man Politburo concluded with a promise to strive to achieve the country’s annual economic goals, the official Xinhua News Agency reported Thursday. Officials pledged action to make the real estate market “stop declining,” their strongest vow yet to stabilize the crucial sector after new-home prices fell in August at the fastest pace since 2014.

The government will also strictly limit the construction of new-home projects, the Politburo said, as part of efforts to ease residential oversupply — although such building has ground to a near-halt.